In insurance broking, managing uncertainty is our bread and butter. It’s our job to take a measured look, and to help our clients respond to eventualities as they emerge. Of course, we can’t offer a helping hand when things go wrong if our own footing isn’t firm. That means having a good idea of what might be coming down the pipe for ourselves … as well as for you.

It’s hard to say that the past year has been great for insurance. Profitability took a dive in 2019, and we’re still waiting for a recovery. APRA’s most recent report shows some growth in profitability, but not much. It’s not all bad news, however: I believe we’re at a point in the insurance cycle where the tide starts coming in again. That is, when there is a more equitable relationship between the degree of risk and costs to transfer it in a policy.

How bad is it, Doc?

On the surface, the picture isn’t pretty. The pattern we’re seeing in insurance is one of rates increasing, capacity receding and profitability staying level. Let’s take a look at what’s behind those trends.

Generally, what causes premiums to go up is big losses like we’ve had over the past few years, with economic upsets and natural disasters. These are situations where insurers are suffering the losses, reducing market capacities and moving out of unprofitable markets that they had previously stayed in. It means premiums go up, and it gets harder to access insurance in certain industries and regions.

There was a good report from Fitch Ratings recently that showed how the insurance industry has been affected over the past couple of years. One result of COVID has actually been a decrease in global risk. For example, there are fewer people on the road, less road freight and logistics and fewer people travelling. So, the risks and payouts around motor insurance have gone down and insurers in that sector have been running more profitably.

In other words, COVID has reduced some operating risks and insurers are rebuilding their coffers and doing what they have to do to remain stable and continue offering coverage.

Things are looking up, actuary

Part of the problem with the pandemic, business-wise, has been uncertainty. This has been a particular problem for insurance, because making good predictions is what makes the industry work.

From looking at “Global reinsurance sector position improving” (an article in Insurance Business Australia that quoted the Fitch report), the uncertainty is going down for three main reasons:

- Pandemic-related losses have stayed within projections so far

- Insurers are responding with COVID-specific language in policies, helping to minimise future payouts and thus protect their ability to offer fairer pricing

- Increasing vaccination rates are cutting health and mortality payouts.

It’s good to look at the situation for reinsurers; after all, they assess the risk represented by insurance companies themselves. Good projections for reinsurers reflect a healthy insurance industry. That said, it can take some time for increased profitability and stability to flow downstream to you, the client. For example, Fitch doesn’t expect reinsurance prices to go down in the coming year, which means consumer-facing insurers are not going to see that benefit.

So, when will my premium go down?

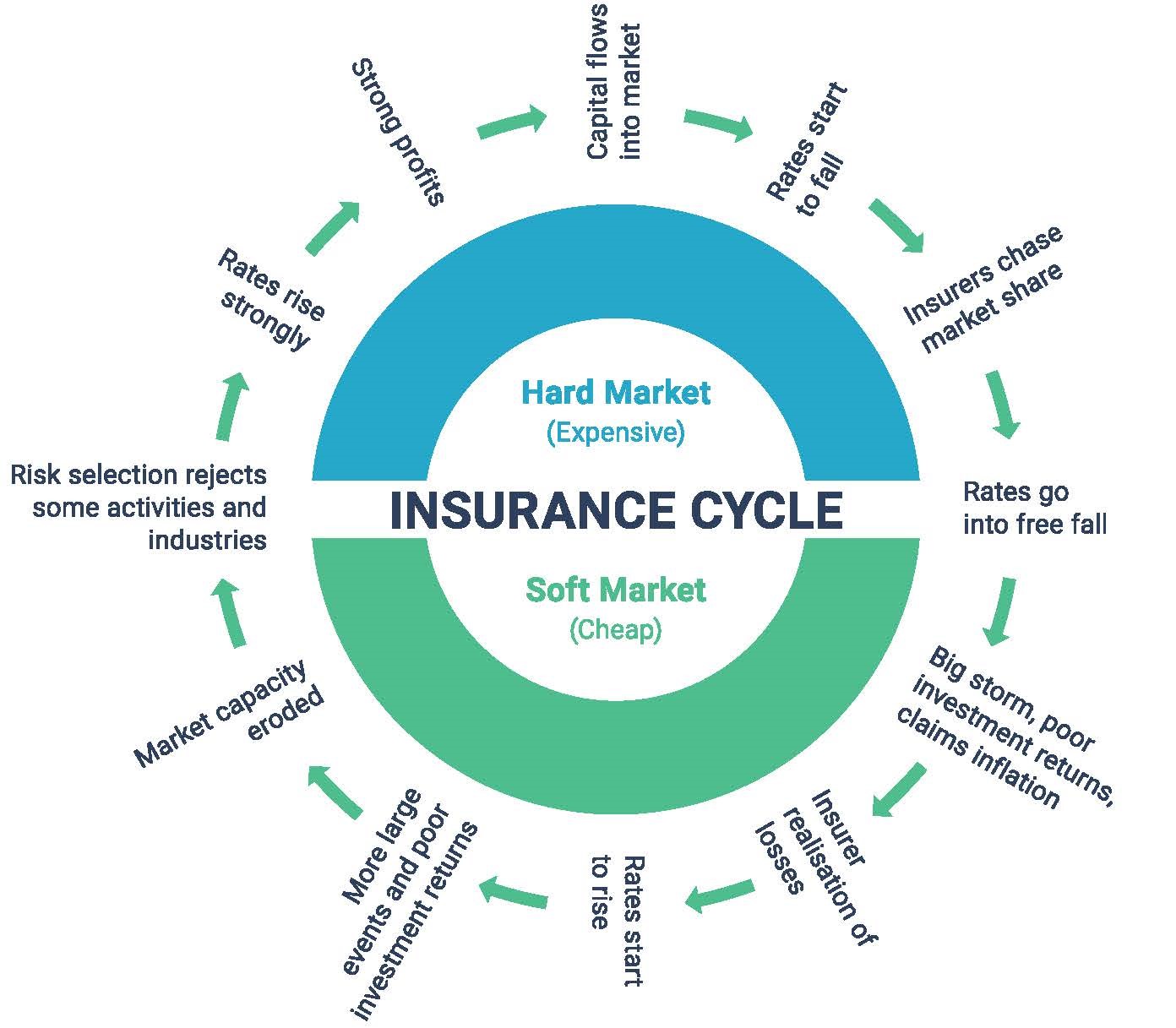

You might be asking “if uncertainty is going down, then what?”. I like to think of the insurance cycle as a clock – when you have a major disaster, that moves the hour hand to 4 o’clock. The market then follows a predictable cycle, where you see insurer losses, rising rates and receding capacity. Eventually, insurer profitability returns, leading to an increase in market capacity, stronger profits, price competition and easing of consumer prices.

Anyway, I think we’ve now spun around to about 10 or 11 o’clock. That means we’re seeing continued strongly rising rates, which will be followed by a period of strong profits. For reinsurers, Fitch expects up to a 2 percent rise in combined ratio in the coming year, and again the year after that.

As we’re entering this hard-market part of the cycle, you can expect to see the following:

- Premiums will probably continue to rise over the coming 12 months

- Getting insurance coverage could become more difficult for many

- Negotiating terms will become harder and take considerably longer to facilitate

- Until higher profit levels return, insurers will reduce capacity

- Higher excesses in general

- A greater focus on risk management and mitigation processes

- More time and additional information will be required from you before insurers offer coverage.

The coming year or two

The cyclical nature of the insurance market means that costs will eventually stabilise and potentially reduce. However, in the immediate future, coverage costs are likely to go up, or plateau. If you haven’t started to focus on your insurance costs as a major business expense, you need to ask what you can do internally to mitigate these exposures.

First of all, if your insurance broker is doing their job well, it should make things easier for everyone: for you and your insurance company! You should get the right – that is, the most accurate – cover for your operations. As always, seek advice from a suitably qualified risk-management professional on controlling and mitigating your risks.